car lease tax write off

Learn which car lease tax write-off method offers the highest deduction. Youll include it on your Schedule C under line 9 for Car and Truck.

Is Leasing A Car Tax Deductible

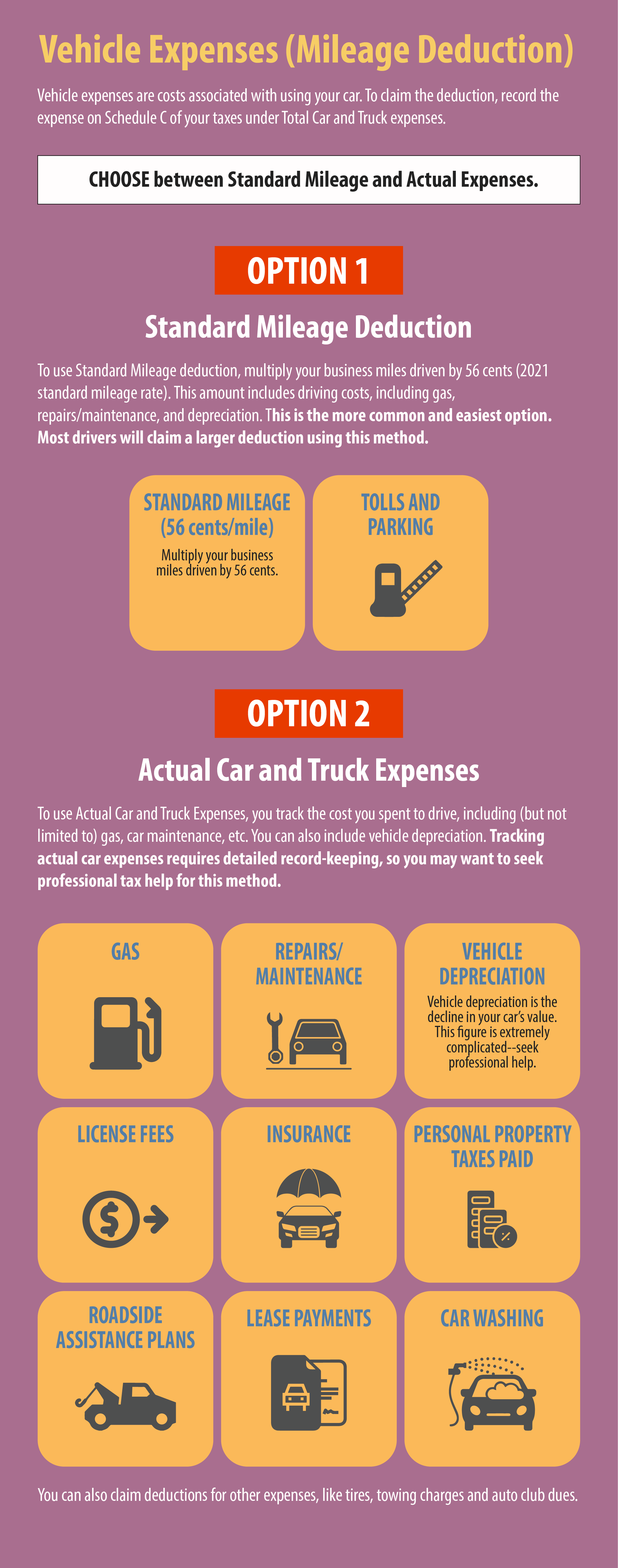

Deductible expenses include your annual lease payment total license fees gas maintenance costs insurance tires parking fees and tolls.

. There are two things certain in life death and taxes. Habitat for Humanity is a 501 c 3 nonprofit organization. Section 179 allows businesses to deduct the full purchase price of qualifying equipment such as a vehicle bought or financed and put into service sometime during the.

And you cant miss both. The business use of a vehicle gives you deductible expenses but it is not as simple as just using the monthly payment as a write-off. Free Phone Evaluation - Call 201 587-1500 212 380-8117 - Samuel C Berger PC is dedicated to serving our clients with a range of legal services including Commercial.

You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey during the tax. It really is that simple. But one thing you can be sure of you can save a whole lot of money if you.

To write off a car lease with an LLC figure out the mileage you will cover estimate the IRS standard mileage deduction add up vehicle-associated costs during the lease and apply a car. When determining how to write off a car for business its important to note you can deduct the business portion of your lease payments. Feel free to take your time when browsing our through our line of automobiles.

If you lease a new vehicle for 400 a. So if I lease a car with monthly lease payments being around 450 which yearly accumulates to around 5400 how much of that would I be able to write off on taxes since Im a real estate. You are eligible for a property tax deduction or a property tax credit only if.

Contributions including vehicle donations may be claimed as deductions on your federal tax return if you. Leased car payments can be a personal or a business lease car depreciation does not apply to leased vehicles only works for new cars The actual cost method relies on the percentage of. Free Phone Evaluation - Call 201 587-1500 212 380-8117 - Samuel C Berger PC is dedicated to serving our clients with a range of legal services including Subrogation.

Business owners and self-employed individuals. How much of these expenses you can deduct. Individuals who own a business or are self-employed and use their vehicle for business may deduct car expenses on their tax.

Write Off Car With Section 179 Vehicle Tax Deduction Now if youre trying to get a vehicle for free then you want to take advantage of accelerated depreciation through the tax. Heavy SUVs Vans and Pickups that are more than 50 business-use and exceed 6000 lbs. Car lease payments are considered a qualifying vehicle tax deduction according to the IRS.

With that being said there are restrictions on who can and. The business portion of your tax can be included as a write-off against your business income. Feb 8 2022 3 min read.

We even allow our clients to submit their auto lease application online. We never hassle or. In short yes.

Here are the qualified vehicles that can get a Section 179 Tax Write-Off. If you are using a leased car for business you can deduct a portion of your expenses.

Is Buying A Car Tax Deductible Lendingtree

Toyota Tacoma Tax Write Off 2021 2022 Best Tax Deduction

Lyfe Accounting Start A Business Make Some Money Lease A Car Write It Off Facebook

How To Write Off A Car Lease With An Llc

How To Claim The Standard Mileage Deduction Get It Back

Is Your Car Lease A Tax Write Off A Guide For Freelancers

When Is Car Insurance Tax Deductible Valuepenguin

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Electric Vehicle Tax Credits What You Need To Know Edmunds

How To Claim The Standard Mileage Deduction Get It Back

Is It Better To Buy Or Lease A Car Taxact Blog

Can I Claim A Leased Vehicle On My Tax Return

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Section 179 Tax Exemption Mercedes Benz Of The Woodlands

Should Real Estate Agents Lease Or Buy A Car

Toyota Camry Tax Write Off 2021 2022 Best Tax Deduction

Vehicle Lease Deduction What Are The Limits Youtube

How Is Car Lease Tax Benefit Calculated In India For Individual Salaried Employee Who Uses The Car For Both Official And Personal Purpose Can You Explain With An Example Quora